As Automotive Insurance Quote: What Indians Often Overlook takes center stage, this opening passage beckons readers with a captivating overview of the key factors, common mistakes, understanding fine print, and declared value in automotive insurance quotes. The content delves into the nuances of the topic, providing valuable insights and practical advice for readers seeking a comprehensive understanding of the subject.

Factors to Consider When Getting an Automotive Insurance Quote

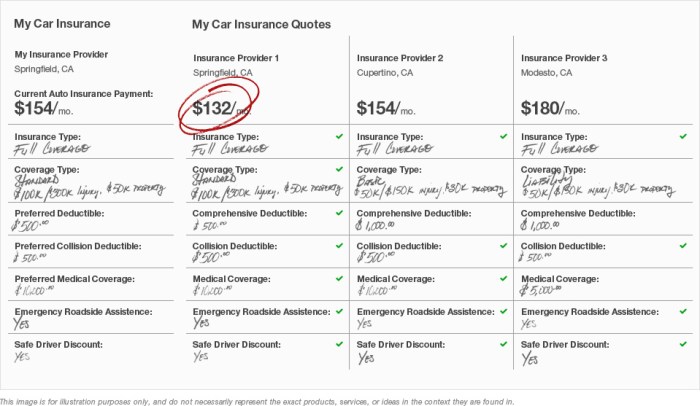

When seeking an automotive insurance quote, there are several key factors that Indians often overlook. It's important to understand the significance of considering factors like coverage limits, deductibles, and add-on benefits to ensure you have adequate protection in case of any unforeseen events.

Coverage Limits

Determining the coverage limits of your automotive insurance policy is crucial. It is essential to assess the maximum amount your insurance provider will pay out for a claim. Overlooking this factor can leave you underinsured in the event of a major accident or loss.

Make sure to review and adjust your coverage limits based on your individual needs and circumstances.

Deductibles

The deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Many Indians tend to overlook the importance of selecting the right deductible amount. Opting for a higher deductible can lower your premium, but it also means you'll have to pay more in the event of a claim.

Consider your financial situation and choose a deductible that you can comfortably afford.

Add-On Benefits

Add-on benefits are additional coverage options that you can include in your automotive insurance policy for extra protection. Indians often overlook the importance of add-on benefits such as roadside assistance, zero depreciation cover, and engine protect cover. These benefits can provide valuable support in emergencies and help minimize out-of-pocket expenses.

Common Mistakes Indians Make When Comparing Insurance Quotes

When comparing automotive insurance quotes, Indians often make some common mistakes that can have a significant impact on the coverage and cost of insurance. It is important to pay attention to the details in order to make an informed decision and ensure adequate protection.

Not Reviewing Coverage Limits

- Many Indians make the mistake of solely focusing on the premium amount without carefully reviewing the coverage limits.

- For example, opting for a lower premium might result in inadequate coverage in the event of an accident or damage to the vehicle.

- It is essential to understand the coverage limits and ensure they align with your needs and potential risks.

Ignoring Additional Benefits

- Some individuals overlook the additional benefits offered by insurance companies, such as roadside assistance, zero depreciation cover, or engine protection.

- By not considering these benefits, policyholders may miss out on valuable services that can enhance their overall insurance experience.

- It is advisable to carefully assess all the additional benefits and choose a policy that provides comprehensive coverage.

Not Comparing Deductibles

- Comparing insurance quotes without considering the deductibles can be a common oversight among Indians.

- Deductibles are the out-of-pocket expenses that policyholders need to pay before the insurance coverage kicks in.

- By neglecting to compare deductibles, individuals may end up with a policy that requires higher out-of-pocket costs in the event of a claim.

Understanding the Fine Print in Insurance Policies

When it comes to automotive insurance, understanding the fine print in insurance policies is crucial for ensuring you are fully aware of what you are covered for. Many Indians often overlook this important aspect of their insurance policies, leading to potential misunderstandings or claim denials in the future.

Importance of Reading the Fine Print

Before signing any insurance policy, it is essential to carefully read and understand the fine print. The fine print contains the specific details and terms of your coverage, including exclusions, limitations, and conditions that may affect your ability to make a claim.

- Pay attention to the coverage limits and deductibles Artikeld in the policy.

- Understand any exclusions or restrictions that may apply to certain situations, such as acts of nature or specific driving behaviors.

- Take note of any additional benefits or services included in the policy, such as roadside assistance or rental car coverage.

Consequences of Overlooking Details

Failure to thoroughly review the fine print can result in misunderstandings or claim denials when you need to utilize your insurance coverage. For example, if you are unaware of a specific exclusion in your policy and file a claim related to that exclusion, your claim may be denied by the insurance company.

It is crucial to be fully informed about your insurance coverage to avoid any surprises or disappointments during the claims process.

Importance of Declared Value in Automotive Insurance

When it comes to automotive insurance, the declared value of your vehicle plays a crucial role in determining the coverage you receive. It is essential to understand the concept of declared value and its significance in the insurance process.

Significance of Accurately Declaring Vehicle Value

- Declared value is the amount you state your vehicle is worth when purchasing insurance. This value serves as the basis for determining your premium and the coverage amount.

- Accurately declaring the value of your vehicle is vital to avoid underinsurance. If you undervalue your car, you may not receive adequate compensation in case of total loss or damage.

- On the other hand, overvaluing your vehicle can lead to higher premiums. Therefore, it is crucial to provide an honest and realistic value to ensure proper coverage.

- During claims, discrepancies in the declared value can result in disputes with the insurance company. To avoid such issues, it is essential to be transparent and truthful when declaring your vehicle's value.

Concluding Remarks

In conclusion, Automotive Insurance Quote: What Indians Often Overlook sheds light on crucial aspects that individuals should consider when exploring automotive insurance options. By highlighting often overlooked factors and common mistakes, this discussion aims to empower readers with the knowledge needed to make informed decisions and avoid potential pitfalls in the insurance process.

Questions Often Asked

What are some key factors Indians often overlook when seeking automotive insurance quotes?

Indians often overlook factors like coverage limits, deductibles, and add-on benefits when obtaining automotive insurance quotes.

What are common mistakes Indians make when comparing insurance quotes?

Common mistakes include overlooking details that can impact coverage and cost, leading to potential misunderstandings or claim denials.

Why is understanding the fine print in insurance policies important?

Understanding the fine print is crucial to avoid misunderstandings or claim denials that may arise from overlooking critical details in the policy terms.

What is the importance of declared value in automotive insurance?

Declared value is crucial to avoid underinsurance or disputes during claims, emphasizing the need for accurately declaring the vehicle's value.